All Categories

Featured

Take Into Consideration Utilizing the penny formula: penny represents Financial debt, Income, Home Mortgage, and Education. Overall your financial obligations, home mortgage, and college expenditures, plus your salary for the variety of years your family needs defense (e.g., until the kids are out of the house), which's your insurance coverage demand. Some monetary specialists determine the quantity you require using the Human Life Value viewpoint, which is your lifetime earnings possible what you're making now, and what you anticipate to gain in the future.

One way to do that is to try to find firms with strong Financial strength rankings. level premium term life insurance policy. 8A business that underwrites its very own plans: Some firms can sell policies from one more insurer, and this can include an added layer if you wish to transform your policy or down the road when your family members requires a payout

Term Life Insurance Uk

Some firms supply this on a year-to-year basis and while you can anticipate your rates to climb significantly, it might deserve it for your survivors. An additional method to contrast insurance coverage firms is by taking a look at on-line client evaluations. While these aren't likely to inform you a lot regarding a business's economic stability, it can inform you how easy they are to work with, and whether claims servicing is a problem.

When you're more youthful, term life insurance coverage can be a simple way to safeguard your liked ones. As life modifications your monetary concerns can as well, so you might want to have whole life insurance for its life time protection and extra benefits that you can use while you're living.

Approval is assured despite your wellness. The premiums won't raise when they're established, however they will certainly go up with age, so it's a great concept to lock them in early. Learn even more regarding just how a term conversion works.

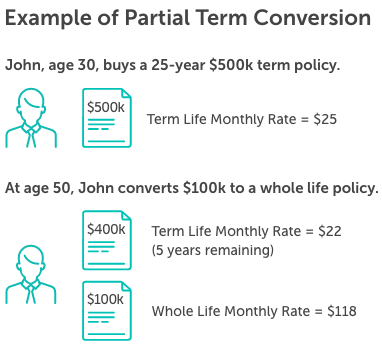

1Term life insurance policy offers short-lived security for an essential duration of time and is usually cheaper than permanent life insurance policy. extending term life insurance. 2Term conversion standards and constraints, such as timing, may apply; for instance, there might be a ten-year conversion opportunity for some items and a five-year conversion advantage for others

3Rider Insured's Paid-Up Insurance Acquisition Choice in New York. There is a cost to exercise this cyclist. Not all taking part plan proprietors are eligible for dividends.

Latest Posts

A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called A(n)

Affordable Funeral Insurance

Final Expense Life Insurance Policy